When the Fed increases its balance sheet it means that money has been created and pumped into the banking system. The Fed does this when it believes the economy needs some jump-starting or support. When money is pumped into the economy, the Fed will buy securities from the banks (thereby increasing its securities holdings); conversely, when the Fed wants to reduce the amount of money in the market, they will sell securities to banks (thereby reducing its securities holdings).

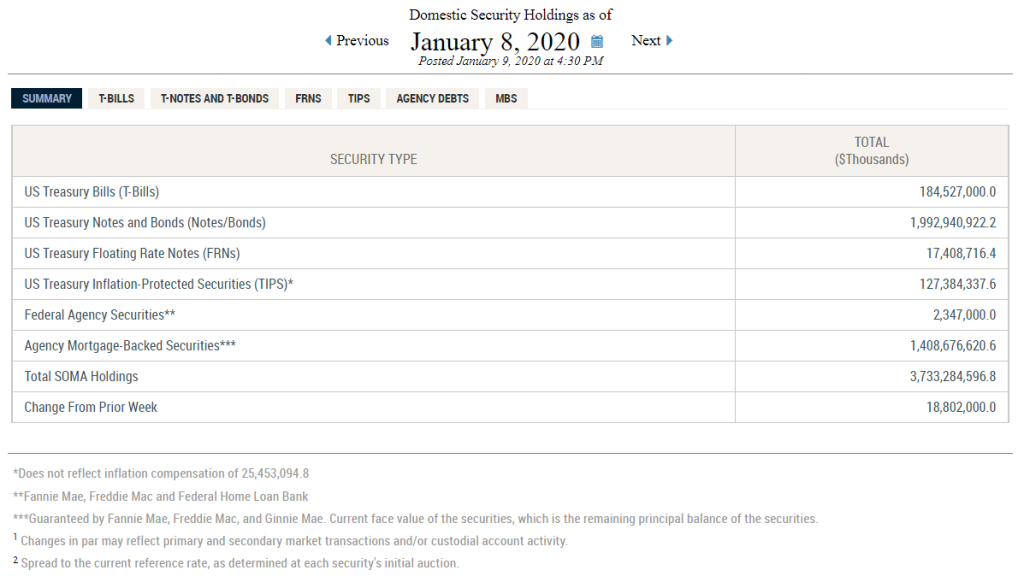

Since March 2020 the Fed has been increasing its balance in manner never seen before. Here is a quick snapshot of the Fed’s holdings of domestic securities. First let’s look at those holding as of January 8, 2020:

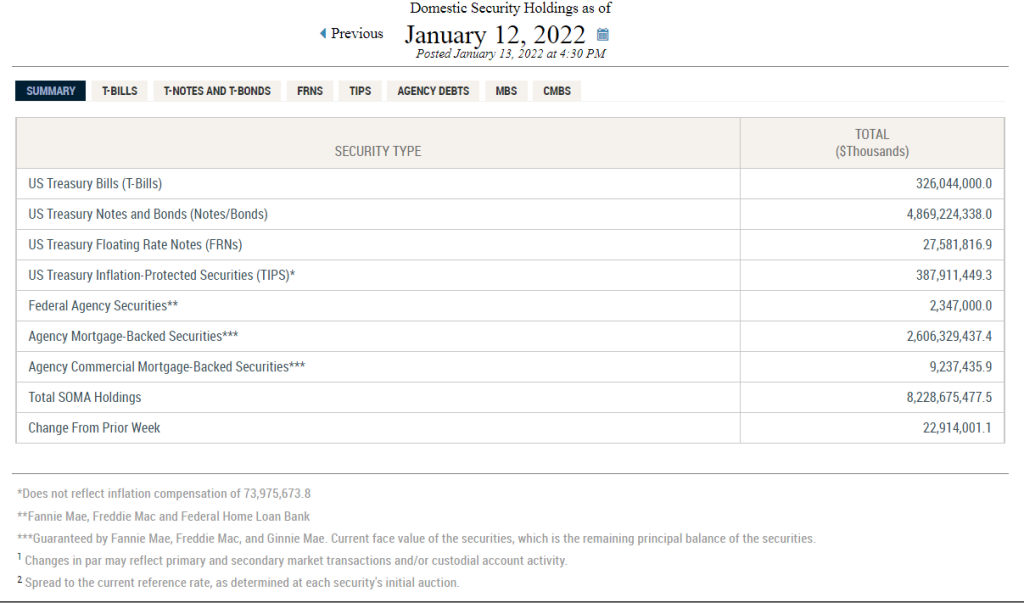

Now look at the latest figures for the same holdings:

During this period, total holdings have increased from $3.7 Trillion to $8.2 Trillion. And to give you broader historical perspective, the current amount is about 11x greater than what was reported in January 9, 2008.

No comments:

Post a Comment