Saturday, January 29, 2022

Inflation has not reared its ugly head…yet!

Saturday, January 22, 2022

Central Bankers’ concern that inflation will get out of hand

Catherine Mann, Bank of England policymaker, made the following statement that is indicative of the dilemma Central Bankers from G5 nations are deliberating:

“Going into 2022, current price and wage expectations coming from the monthly decision maker panel [a monthly business survey] are inconsistent with the 2 per cent target, and if they are realised in 2022 are likely to keep inflation strong for longer…It should be a concern that the costs from 2021 are becoming reflected in price expectations for 2022,” she said, adding: “Changing expectations is the first defence against a reinforcing wage-price dynamic.”

2% is the threshold that the most influential Central Banks in the world have adopted in order to manage their monetary policy in the context of maintaining a stable monetary system. When inflation is shoots above or below that threshold, it marks the point at which deliberations must take place to assure price remain stable. Unstable prices produce a lot of uncertainty, which hinders economic growth. When price are increasing at a faster pace than the expected 2% per annum, it means that the Central Bank must conduct monetary policy to the rate within the threshold range.

However, when expectations from people get entrenched, especially when they look at the past in order to forecast the future, it becomes exceedingly difficult for Central Bankers to re-anchor those expectations. At this time, the market expects that Central Banks will reduce the money supply and be successful in reining in inflation. Why does the market believe this? Because it has worked in the past. The trouble would be if Central Banks fail in execution, which would then possibly lead people to lose faith in their ability to curtail inflation.

Wednesday, January 19, 2022

Ballooning Fed’s Balance Sheet

When the Fed increases its balance sheet it means that money has been created and pumped into the banking system. The Fed does this when it believes the economy needs some jump-starting or support. When money is pumped into the economy, the Fed will buy securities from the banks (thereby increasing its securities holdings); conversely, when the Fed wants to reduce the amount of money in the market, they will sell securities to banks (thereby reducing its securities holdings).

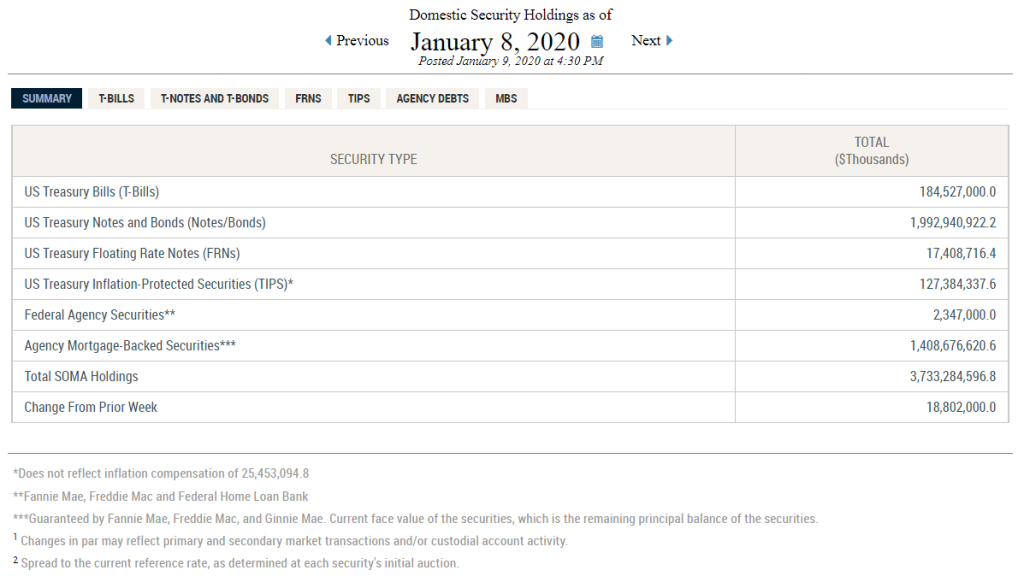

Since March 2020 the Fed has been increasing its balance in manner never seen before. Here is a quick snapshot of the Fed’s holdings of domestic securities. First let’s look at those holding as of January 8, 2020:

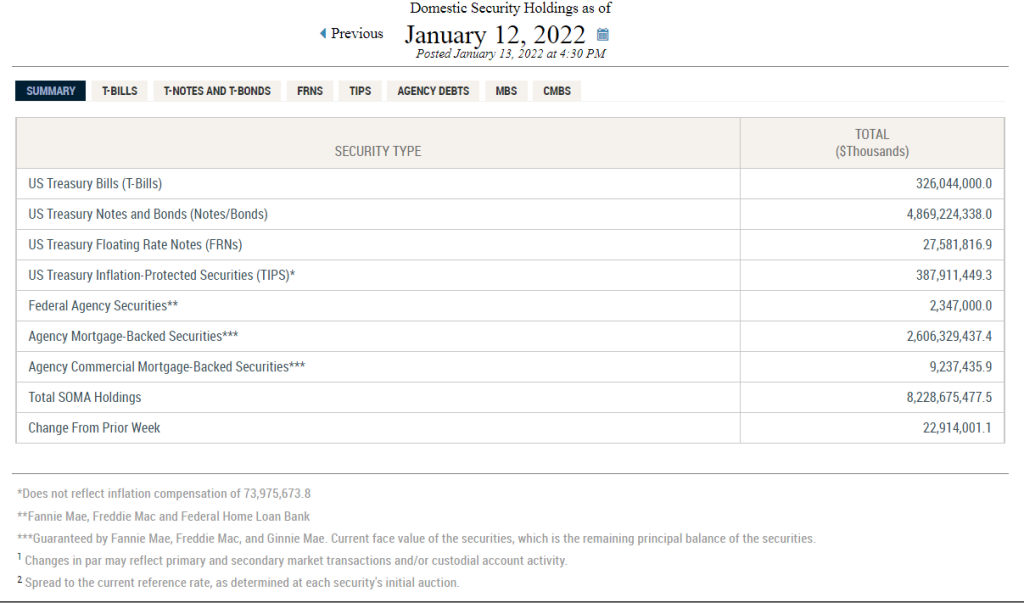

Now look at the latest figures for the same holdings:

During this period, total holdings have increased from $3.7 Trillion to $8.2 Trillion. And to give you broader historical perspective, the current amount is about 11x greater than what was reported in January 9, 2008.

Tuesday, January 18, 2022

US Treasuries sell off as markets price in Fed rate rises this year

The 10-year Treasury has been selling off. This is how the yield curve looks like as of January 18th:

An increase in yield means bond prices are falling – hence the term of sell-off when we are talking about fixed income markets.

When we look at the CME FedWatch tool to assess the probabilities of a rate hike this year we can see that this is a foregone conclusion. Take a look at the December 2022 probabilities, which are derived from the Fed Fund Futures contract prices:

We see that there is a 32.8% probability that rates will be within the 1 – 1.25% range; 26.9% within the 1.25 – 1.50% range; and 11.2% within 1.5 – 1.75% range. Adding these probabilities we see that there is approximately 70% chance we will see the Fed Fund rate above 1% by the end of this year (current rate is between 0 - .25%). This tells us that indeed investors are expecting multiple Fed rate rises this year.

Monday, January 17, 2022

CPI vs. Treasury Bonds

On 12/1/2021, the yield on the 30-year T-bond was 1.77%.

On 12/31/2021 the yield had risen to 1.90%, and as of 1/14/2022 it further

increased to 2.12%. While the trend is up, the yield is still below the peak

for 2021, which was about 2.45% back in March. Yield curve rates can be seen here.

This tells me that while the CPI has been increasing, bond investors still do not believe that there are significant risks when it comes to runaway inflation. They likely believe that the Federal Reserve will be able to execute monetary policy effectively to quell the recent CPI increases. Is that a fair expectation? Maybe. It depends whether they believe that what has worked in the past will work in the future. In other words, the past is a good indication of the future.

In addition, what the behavior of the 30-year yield tells me also is that investors are more concern about recession than inflation. In a recession one would expect prices to decline, so the likelihood of mass inflation happening in the immediate future is quite low. Of course, like what happened in the 1970s, we can have a scenario where we have at the same time a recession and rising prices; but again, bond investors are currently discounting that possibility.

Saturday, January 15, 2022

Investors bet on loans as Fed readies to lift interest rates

The Financial Times recently describe some of the impact that an expected rise in interest rates by the Federal Reserve in 2022 is having in the market for US loans.

“I think we may have reached the inflection point. The question is no longer ‘if’ rates will go higher, but ‘how soon and by how much’,” said Jeff Bakalar, group head of leveraged credit at Voya Investment Management. “Every time this has happened, the loan market has become a safe harbour.”

Also, as some Citigroup analysts commented, “Loans provide two much-needed characteristics for investors in 2022 — rate protection and relatively stable performance.”

Here is a broad overview of the weekly flow of money chasing US loan funds:

The article, however, fails to mention both sides of the

equation in terms of determining overall profitability. Indeed, an investor in

a US loan fund would benefit from a rise in interest rates, presumably because

those loans would reprise higher and thus distribute higher cashflows. However,

a tight monetary policy would have an effect of cooling of the economy, which

increases the risk in some firms to go bankrupt or reduce economic profits,

which would ultimately reduce the value of certain funds.