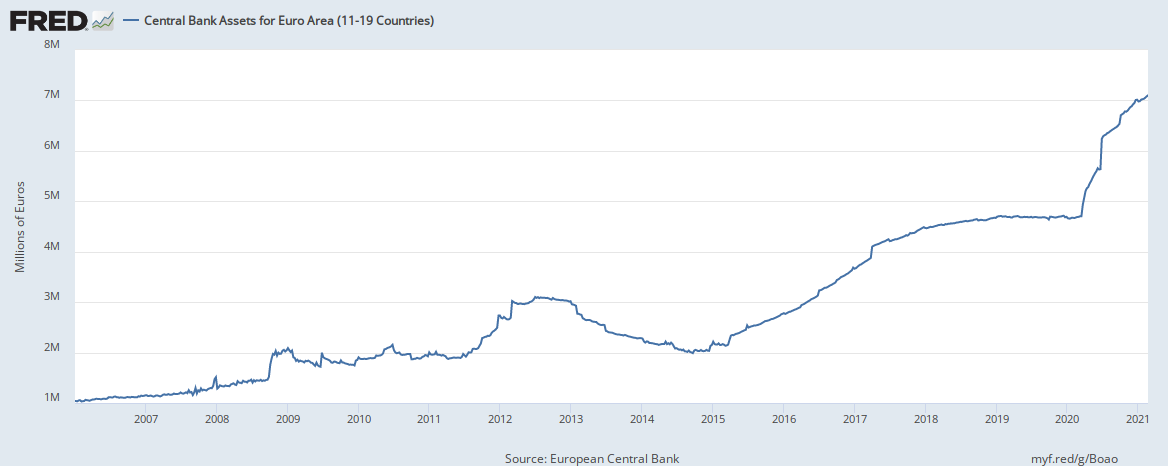

According to Marketwatch, from the beginning of 2021 through February 26, 2021 the price of gold has declined approximately 9%, and for the week of February 22, 2021 its price declined about 2.8%. On the other hand, during the same time frame, the 10-year US Treasury Note yield has increased from 0.917% to 1.415%. This increase in bond yield has put downward pressure to gold prices, given that it is a non-yielding asset.

It is widely reported that the increase in bond yields is the result of positive expectations that the economy will improve at a faster pace than initially thought. Following the conventional economic logic of this argument, as the economy improves faster than expected, general pressure in consumer prices will increase, which leads to inflationary pressures and thereby increasing the premium in bond interest rates. Viewed from a different perspective, when we look at the 10-year Treasury Inflation-Indexed Security (TIPS) we see that at the beginning of 2021 it stood at -1.08% and as of 2-25-2021 the rate stood at -0.60%. Negative TIPS rates mean that when the principal is paid it is adjusted downward and obviously interest payments are less than they would be otherwise when compared to a regular bond. Currently for TIPS, if at maturity the adjusted principal is less than the original principal, the government will give you the original amount invested. Nevertheless, the point made here is that at this moment, based on TIPS rates there is an expectation of consumer prices increasing, which as I have said earlier it is because there is an expectation of improved economic conditions happening more quickly than initially believed.

Based on my view, however, the economic improvement currently underway is the result of increase “opening” of the economy from government lockdowns. Coupled with massive liquidity injected by government authorities, it is giving the illusion of prosperity. Like a massive Ponzi scheme, only more debt will sustain the illusion. But like all illusions, when reality sets in there will be a massive amount of disappointment. The market’s pullback from the last couple of days is merely a canary in the coal mine. No one knows the day and time when reality will set in, but in the meantime you would be wise to consider what I shared earlier today.