In an age where massive liquidity injections are causing all sort of market distortions, some peculiar activities often take place, which at the moment they may not look aberrant. It is only in hindsight that we have 20/20 vision. For example, prior to the financial crisis of 2008-2009, I recall that some hedge funds were going public. If we think about it, the main value that a hedge fund brings is that it has a greater ability when compared to other portfolio managers to generate extra returns. This extra return is what’s called the “alpha” in the investment vernacular. If investing in a passive market Index simply generates some sort of return, then when you beat the market – that extra return – you are said to generate alpha. In plain English, alpha is your value. When hedge funds began to go public around 2006, effectively they were selling the alpha that no longer existed. They were cashing in on perceived value, not real value.

So I take notice when I come across articles, such as

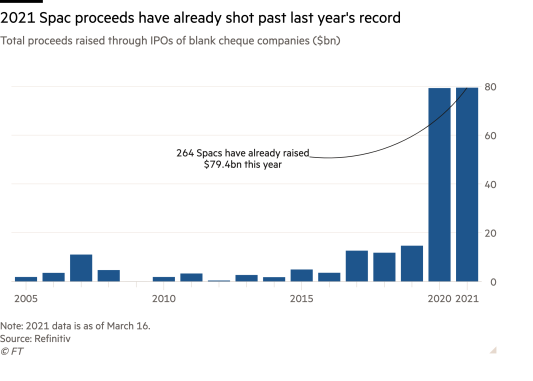

this one from the FT, that calls attention to special purpose acquisition

companies (SPACs) and mentions that YTD 2021 has outdone 2020 in money flowing

to these entities. In particular it says that:

Spacs have raised $79.4bn globally since the start of the year, eclipsing the $79.3bn that flooded into vehicles in 2020, according to data provider Refinitiv, as of Tuesday night. So far in 2021, 264 new Spacs have been launched, overtaking last year’s record 256.

In an economy that has been juiced by massive monetary and fiscal policies over the last year, coupled with the economic disruptions from the lockdowns, the available companies that indeed generate value are rare. Money printing does not generate sustainable economic growth. What many of these SPACs are doing is simply funding bad investment that at some point will lose significant value, if not outright default. Why would a company want to sell itself to a SPAC when they know that they truly generate value? It is not rational for a business person to do that: a handful? Maybe; but a bunch? No! Of course, if a business is barely holding on because of government bailouts, then you can rest assure that many of those are the first in line to be sold to a SPAC.

SPAC Proceeds

No comments:

Post a Comment